PMAY Gramin scheme details: The Pradhan Mantri Gramin Awaas Yojana (PMAY-G) is a government-led initiative to provide affordable housing to rural poor households in India. The scheme was launched in 2016 as a successor to the Indira Awaas Yojana (IAY), which was implemented from 1985 to 2016.

Under the PMAY-G, eligible households are provided with a grant of INR 2.67 lakhs (US$36,000) to construct a pucca (permanent) house with basic amenities such as a kitchen, toilet, and water supply. The scheme is targeted at households living in kutcha (temporary) houses or those who do not own a house.

The PMAY-G is a demand-driven scheme, which means that beneficiaries can apply for the scheme on their own. The scheme is implemented by the Ministry of Rural Development (MoRD) through state governments and district administrations.

As of August 2023, over 14.35 million houses have been constructed or approved under the PMAY-G. The scheme has been a major success in providing affordable housing to rural poor households in India.

Here are some of the key features of the PMAY-G:

- The scheme is targeted at rural poor households.

- Eligible households are provided with a grant of INR 2.67 lakhs to construct a pucca house.

- The scheme is demand-driven.

- The scheme is implemented by the MoRD through state governments and district administrations.

The PMAY-G is a major initiative by the government of India to address the issue of housing shortage in rural areas. The scheme has been successful in providing affordable housing to millions of people so far, and it is expected to continue to benefit millions more in the years to come.

Features of the PMAY Gramin Scheme

The Pradhan Mantri Awas Yojana Gramin (PMAY-G) is a government-led initiative to provide affordable housing to rural households in India. The scheme was launched in 2015 and aims to provide 2.95 crore pucca (permanent) houses to eligible beneficiaries by 2022.

Step 1: Introduction This comprehensive welfare plan encompasses several prominent features aimed at enhancing the living conditions of the rural underprivileged population.

Step 2: Cost Distribution for Housing Benefits The financial burden of providing housing benefits to rural impoverished individuals will be shared by both the Central and State Governments. The prevailing cost-sharing ratio is set at 60:40, with the latter figure representing the respective contribution of each state. In non-hilly states, a uniform total contribution of Rs 1.20 Lakh will be allocated.

Step 3: Allocation in Hilly States In hilly states, particularly within the Northern region, a different contribution ratio of 90:10 is established, with the Central Government furnishing 90% of the funding. This arrangement also applies to the Union Territory of Jammu and Kashmir. Under this provision, a total of Rs 1.30 Lakh will be available for the construction of permanent housing.

Step 4: Funding for Union Territories For all other Union Territories, complete funding amounting to 100% will be provided by the Central Government. A specific breakdown of the total incurred costs, however, is not outlined.

Step 5: Implementation of PMAY Gramin Scheme The existing non-permanent housing structures will be replaced by the PMAY Gramin scheme, a move that promises to significantly elevate the quality of living for the rural impoverished populace.

Step 6: Additional Assistance for Sanitary Facilities An additional financial provision of Rs. 12,000 per beneficiary will be allocated to facilitate the construction of permanent toilets alongside each housing unit. This supplementary aid falls under the Swachh Bharat Mission-Gramin (SBM-G), a program aimed at ensuring widespread access to hygienic living conditions – a key initiative of the Government.

Step 7: Income Support through MGNREGS Beneficiaries of this scheme will also receive a daily wage of Rs 90.95 for unskilled labor, administered through the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS).

Step 8: Beneficiary Selection Process The selection of beneficiaries will be contingent on their social indicators as ascertained by the Socio-Economic and Caste Census (SECC). Subsequently, the respective gram sabhas will oversee data verification and transmit this information to the administrative authorities.

Step 9: Transparent Disbursement Mechanism The Pradhan Mantri Awas Yojana Gramin underscores transparency. Payments will be directly transferred to the beneficiaries’ bank accounts, with Aadhaar data authentication ensuring that funds are exclusively received by eligible recipients.

How to Apply for PMAYG

How to Apply PMAYG Is Below are the instructions to be adhered to when including a new beneficiary in this program. These steps are relevant only in cases where the beneficiary has already met the eligibility criteria but hasn’t been integrated into the system’s records yet.

- Log in to the official website of PMAY-G.

- Fill in the personal details of the beneficiary, including gender, Aadhaar number, mobile number, and other details.

- Upload the consent letter for using the Aadhaar data.

- Click on the “Search” button to view the beneficiary’s details.

- If the beneficiary is eligible for the scheme, click on the “Register” button.

- The beneficiary’s details will automatically appear. Check to make sure that the information is accurate and updated.

- Fill in the remaining fields, including Aadhaar details, details of nomination, bank account, etc.

- If the beneficiary wants to avail of a loan under the scheme, click on “Yes” and fill in the amount required as a loan.

- Finally, upload the SBM and MGNREGS details.

- The assigned authority will process the request to add the beneficiary to the scheme.

Read Also: Pradhan Mantri Awas Yojana Gramin (PMAY-G) Registration Form 2023

Here are some additional things to keep in mind:

- The beneficiary must be eligible for the scheme.

- The beneficiary must have a valid Aadhaar number.

- The beneficiary must have a bank account.

- The beneficiary must provide all of the required documentation.

Pradhan Mantri Awaas Yojana Gramin (PMAYG) – Benefits

Under the Pradhan Mantri Awas Yojana (PMAY), beneficiaries can avail of loans of up to INR 70,000 from pre-approved financial institutions to build a pucca house.

The interest rate on these loans is 3% lower than the regular lending rate. The maximum principal amount for which subsidy is available is INR 2 lakh.

Beneficiaries also get additional benefits such as LPG connections under the Pradhan Mantri Ujjwala Yojana and other essential facilities. Houses constructed in hilly areas are eligible for higher financial assistance.

- All beneficiaries of this scheme can avail of loans of up to Rs. 70,000 from pre-determined financial institutions. This sum will then be used to build a permanent dwelling.

- There are some benefits available when repaying this amount. For one, interest rates will be lower by 3% when compared to ordinary, non-subsidized loans.

- The maximum principal amount for which subsidy can be sought is Rs. 2 Lakh.

- Added benefits like LPG connections covered under the Ujjwala Yojana and other essential facilities also exist.

- Houses constructed in hilly terrains will have increased financial assistance.

Eligibility for PMAYG

Here are the eligibility criteria for the Pradhan Mantri Awas Yojana – Gramin (PMAYG):

- The applicant must be a citizen of India.

- The applicant’s annual income must not exceed INR 3 lakhs.

- The applicant must not own a pucca house in any part of the country.

- The applicant must have a valid Aadhaar card.

- The applicant must have a bank account in his/her name.

In addition to these criteria, there are also some additional criteria for specific categories of beneficiaries:

- Households headed by women: The household must be headed by a woman.

- Households with disabled members: The household must have at least one disabled member.

- Households in hilly areas: The household must be located in a hilly area.

- Households in rural areas with no access to electricity: The household must be located in a rural area and must not have access to electricity.

If you meet the eligibility criteria, you can apply for the PMAYG scheme through the Pradhan Mantri Awas Yojana website or at any Common Service Centre (CSC).

Here are some of the documents you will need to submit along with your application form:

- Aadhaar cards of all the members of the household

- Income certificate

- Bank account details

- Proof of residence

- Proof of ownership of the land (if applicable)

Read Alos: Pradhan Mantri Awas Yojana online apply 2023-24 (Latest Update)

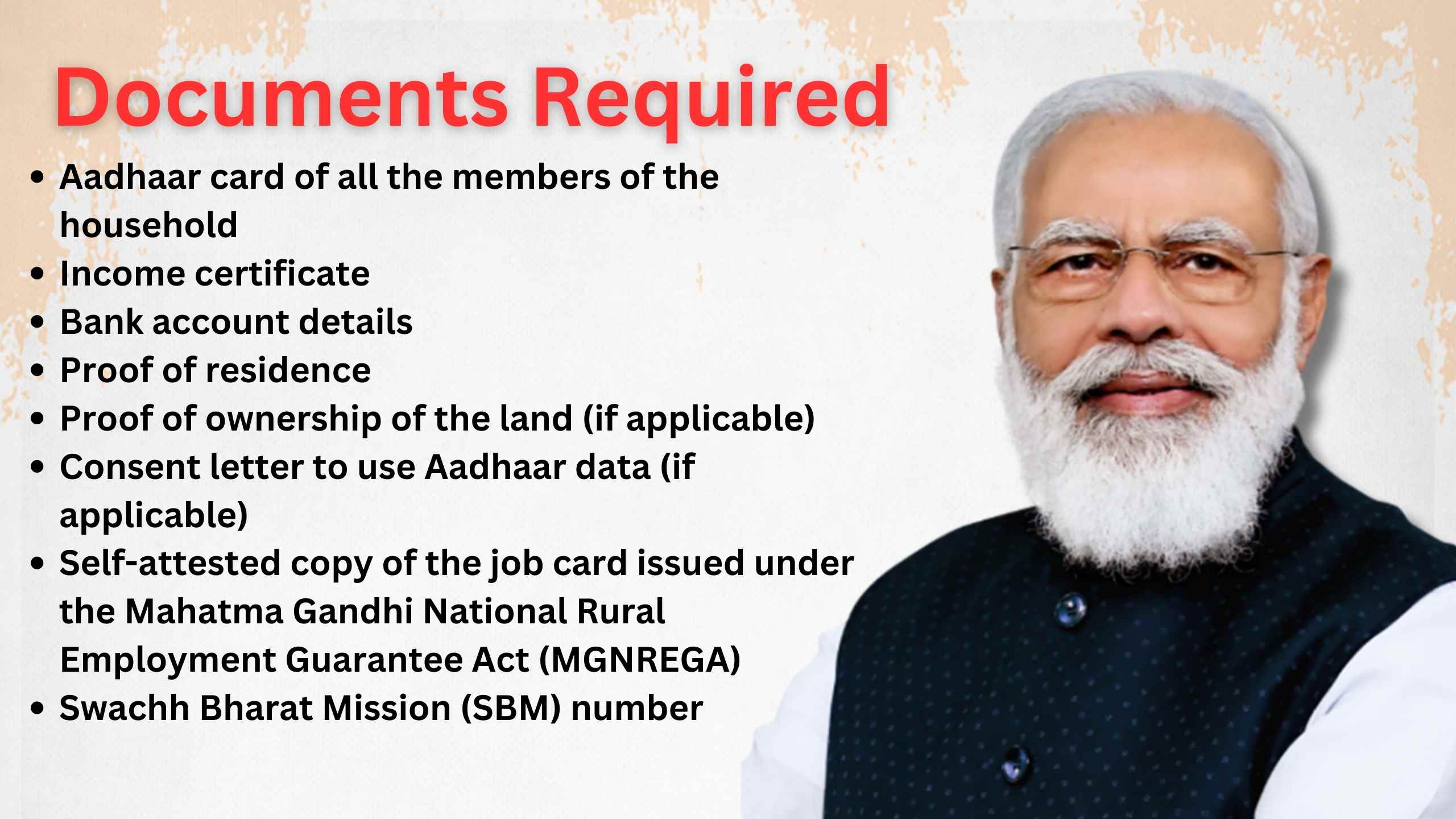

Documents Required to Apply for PMAY G

The following are the documents required to apply for the Pradhan Mantri Awas Yojana Gramin (PMAY-G) scheme:

- Aadhaar card of all the members of the household

- Income certificate

- Bank account details

- Proof of residence

- Proof of ownership of the land (if applicable)

- Consent letter to use Aadhaar data (if applicable)

- Self-attested copy of the job card issued under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)

- Swachh Bharat Mission (SBM) number

If you are applying for a loan from a bank, you will also need to provide the following documents:

- Loan application form

- Property valuation report

- No objection certificate from the local authority

- Insurance certificate

You can apply for the PMAY-G scheme online or offline. To apply online, you can visit the PMAY-G website and create an account. To apply offline, you can submit a hard copy of the application form to the nearest bank branch or Common Service Centre (CSC).

The PMAY-G scheme is a great opportunity for rural households to own a pucca house. If you are eligible for the scheme, I encourage you to apply.

Here are some additional tips for applying for the PMAY-G scheme:

- Make sure you have all the required documents ready before you start the application process.

- Double-check all your information carefully before submitting the application form.

- Follow up with the bank or CSC regularly to check on the status of your application.

Check the PMAY Gramin List

The government uses the Socio-Economic Caste Census (SECC) data to identify eligible beneficiaries for the Pradhan Mantri Awas Yojana (PMAY). The SECC data collects information on household income, assets, and housing conditions. Based on this data, the state governments prioritize beneficiaries for the scheme.

The Gram Sabhas, which are village councils, are also consulted in the identification of beneficiaries. The Gram Sabhas are responsible for verifying the information collected in the SECC data and ensuring that the beneficiaries are truly eligible for the scheme.

Once the beneficiaries have been identified, a final list is published. This list is also updated continuously to reflect any changes in the eligibility criteria or the beneficiary status.

How To Check the PMAY Gramin List

You can check the PMAY Gramin list in the following ways:

- Online: You can check the list online through the PMAY-G website at https://pmayg.nic.in/. You will need to enter your name, state, district, and block to search for your name in the list.

- By SMS: You can also check the list by sending an SMS to 8448824433. The SMS format is:

PMAY <space> State Code <space> District Code <space> Block Code <space> Name

For example, if you are checking the list for the state of Uttar Pradesh, district of Ghaziabad, and block of Loni, you will send the following SMS:

PMAY 09 20 1401 Name

The PMAY authorities will send you an SMS with the status of your application.

- Through the Public Grievance Redressal System (PGRS): You can also check the list through the PGRS. The PGRS is a web-based system that allows you to file grievances and complaints related to the PMAY scheme. To check the list through the PGRS, you will need to create an account and login to the system.

Once you have logged in to the system, you can search for your name in the PMAY Gramin list. You can also view the status of your application and file a grievance if you are not satisfied with the status.

How to Check PMAYG Application Status

There are two ways to check the status of your Pradhan Mantri Awas Yojana Gramin (PMAYG) application:

- Online: You can check the status of your application online through the PMAYG website at https://pmayg.nic.in/. You will need to enter your application ID and the OTP that will be sent to your registered mobile number.

- By SMS: You can also check the status of your application by sending an SMS to 8448824433. The SMS format is:

PMAYG <space> Application ID

For example, if your application ID is 1234567890, you will send the following SMS:

PMAYG 1234567890

The PMAY authorities will send you an SMS with the status of your application.

Here are the possible statuses of your PMAYG application:

- Pending: Your application is still under review.

- Approved: Your application has been approved and you are eligible for the benefits of the scheme.

- Rejected: Your application has been rejected. You can contact the PMAY authorities to know the reason for the rejection.

- Under Process: The process of disbursing the benefits of the scheme is underway.

- Completed: The benefits of the scheme have been disbursed to you.

If you have any questions about the PMAYG scheme or the application process, you can contact the PMAY authorities at 1800-11-6686.

FAQs

How can I avail the interest subsidy benefit under this scheme?

To avail the interest subsidy benefit under the Pradhan Mantri Awas Yojana Gramin (PMAYG) scheme, you need to take a loan from a bank or other financial institution that is empanelled under the scheme. The interest subsidy will be provided by the government directly to the bank or financial institution.

The amount of interest subsidy depends on your income category and the type of house you are constructing. For EWS and LIG households, the interest subsidy is 6.5% on a loan of up to INR 2 lakhs. For MIG I households, the interest subsidy is 4% on a loan of up to INR 3 lakhs. For MIG II households, the interest subsidy is 3% on a loan of up to INR 4 lakhs.

Is there any limit on the tenure for which this scheme is available?

The maximum tenure for which the PMAYG scheme is available is 20 years. However, the actual tenure will depend on the amount of loan you take and your repayment capacity.

Do I have to consult with my local Gram Sabha to get approval for this scheme?

No, you do not have to consult with your local Gram Sabha to get approval for the PMAYG scheme. However, it is advisable to do so as the Gram Sabha can provide you with information about the scheme and help you with the application process.

Can I acquire a loan through the PMAYG Scheme if I live in a remote area?

Yes, you can acquire a loan through the PMAYG scheme if you live in a remote area. The government has specifically designed the scheme to benefit people living in rural areas.

Can existing house loan borrowers apply for a loan under the PMAYG Scheme?

Yes, existing house loan borrowers can apply for a loan under the PMAYG scheme. However, they will not be eligible for the interest subsidy benefit.

6 thoughts on “[ Updated ] – PMAY Gramin scheme details 2023-24”